How Will The Change In Accounts Payable Be Shown On The Statement Of Cashã¢â‚¬â€¹ Flows?

November 2, 2021 November 2, 2021 https://quickbooks.intuit.com/r/growing-circuitous-businesses/statement-of-cash-flows/ Growing & Circuitous Businesses en_US The statement of cash flows, or cash menstruation argument, accounting for a menstruum's change in cash, should be reviewed regularly and managed effectively. https://quickbooks.intuit.com/cas/dam/Epitome/A9yx87Q6V/statement-of-cash-flows-header-u.s..jpg https://quickbooks.intuit.com/r/growing-complex-businesses/statement-of-greenbacks-flows/ Argument of greenbacks flows: What it is & how to read it Ken Boyd

Cash flow management is a common challenge for many concern owners. You demand cash to evangelize a production or service to your customers, and to fund business investments. No company can operate without sufficient cash inflows, and you need tools to sympathise your cash position.

What is a cash flow statement?

A cash menstruum statement, or statement of cash flows, reports your firm'south cash receipts and outflows for a specific fourth dimension period, ordinarily a calendar month or year. If you review the statement of cash flows each month, you can make better decisions and manage your cash more effectively. The greenbacks flow statement is among the remainder sheet and the income statement as the three important and interconnected fiscal statements.

How the financial reports are connected

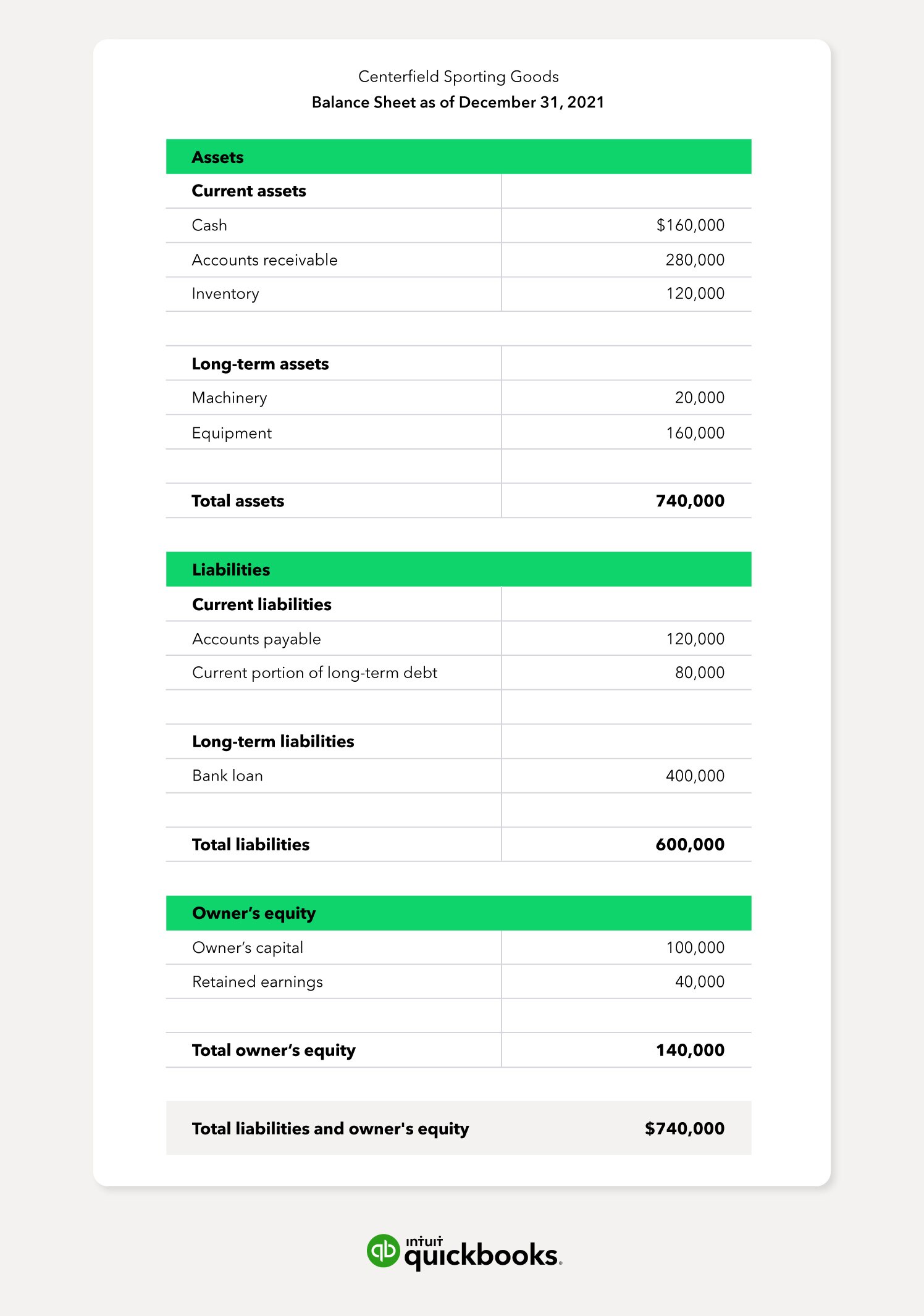

A balance sheet is a snapshot of a company's financial position every bit of a specific engagement. The balance sheet lists a firm'south assets, liabilities, and owner's equity balances for a month or year.

The 2 other financial statements are connected to the balance sheet. An income argument reports revenue, expenses, and net income for a specific flow of time. The cyberspace income balance in the income statement increases the possessor's equity balance in the balance sheet.

A cash menstruum statement lists the cash inflows and outflow of cash for a period of time, and the ending cash residuum is the same dollar amount reported in the residuum canvass. If you lot create a June greenbacks catamenia statement, for example, the June 30 cash residuum in the cash flow statement equals the greenbacks balance in the June 30 residue sheet.

The statement of cash flows helps a business organisation owner understand the differences between net income and the action in the cash account. These differences occur when a company uses the accrual method of accounting.

Cash basis vs. accrual basis accounting

All businesses should apply the accrual ground of accounting, so that revenue is posted when information technology is earned, and expenses are posted when they are incurred. Using this method matches revenue earned with the expenses incurred to generate the revenue, and the organisation presents a more accurate view of your profitability.

The cash basis of accounting, on the other hand, distorts your truthful level of profit, and does not conform to Mostly Accepted Accounting Principles (GAAP). The cash basis of accounting records revenue when cash is received, and posts expenses only when they are paid. The instance below presents a detailed statement of cash flows, and how the statement is connected to the balance sheet and the income statement.

Greenbacks flow argument case

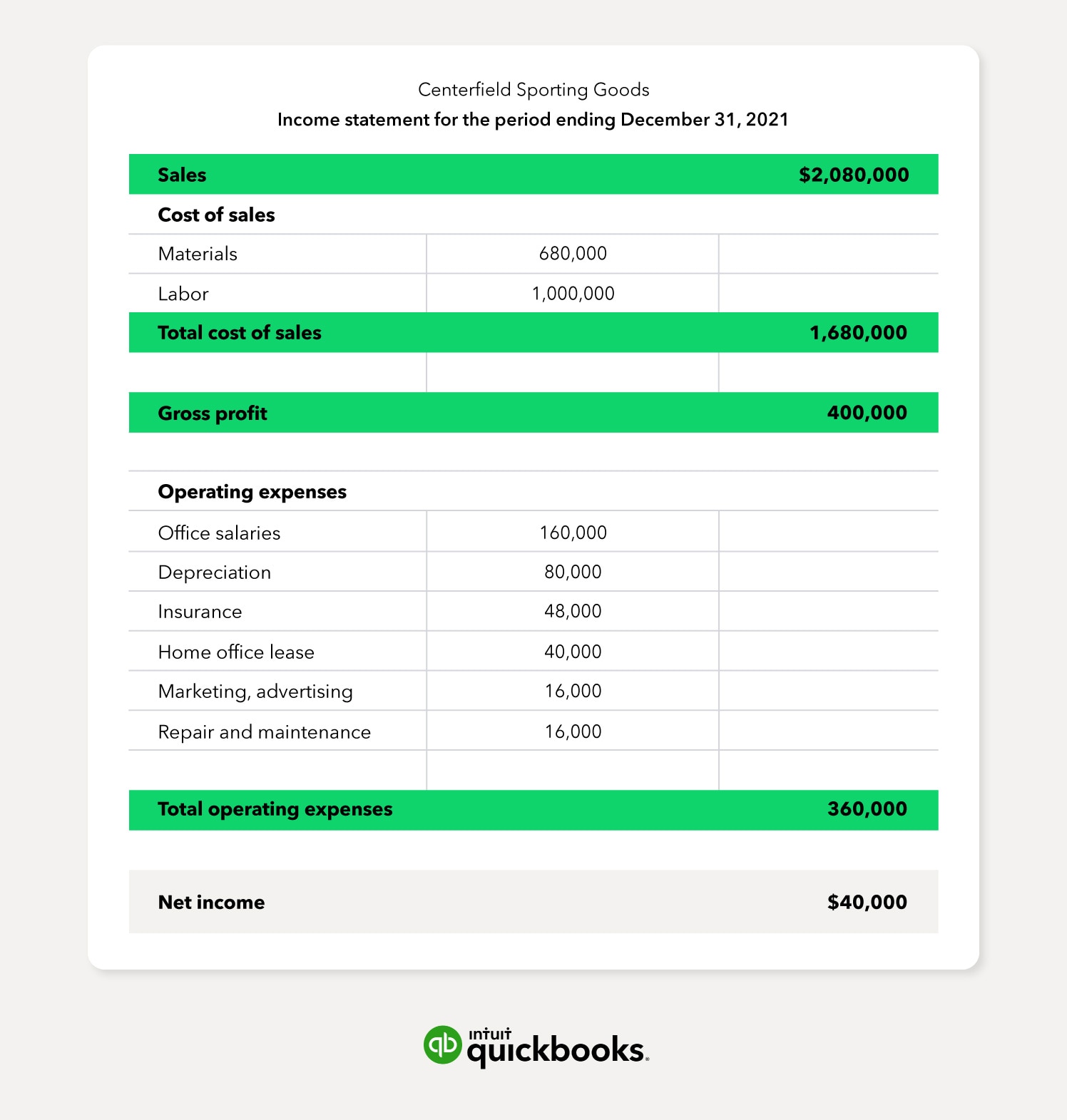

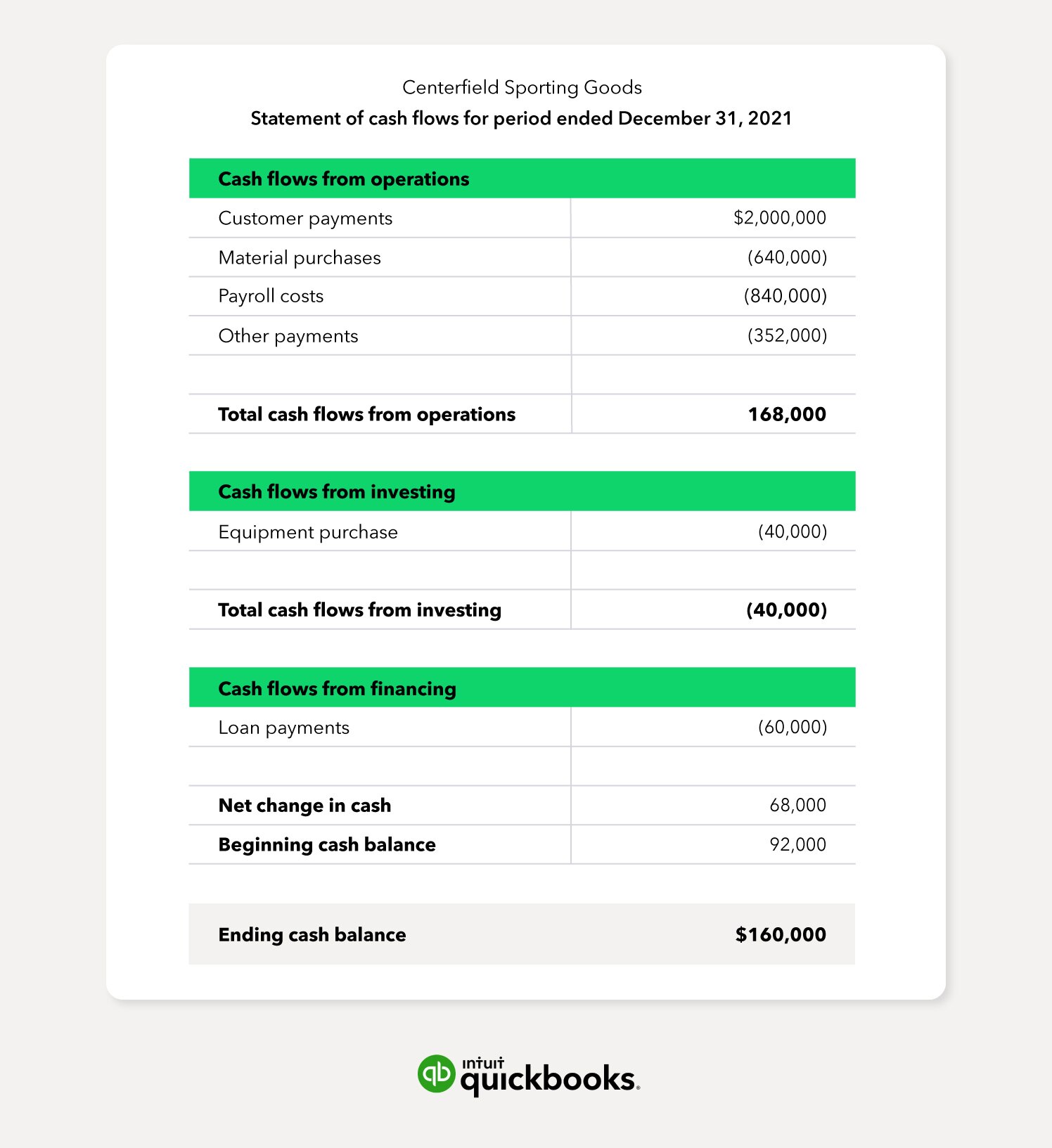

Julie owns Centerfield Sporting Appurtenances, a firm that articles sporting appurtenances products and sells them to retailers. Here is Centerfield's income statement and remainder sheet as of 12/31/21:

The income statement reports $twoscore,000 in internet income for the year, and net income increases retained earnings in the equity department of the balance sheet. Side by side is the statement of cash flows.

How to read a greenbacks flow argument

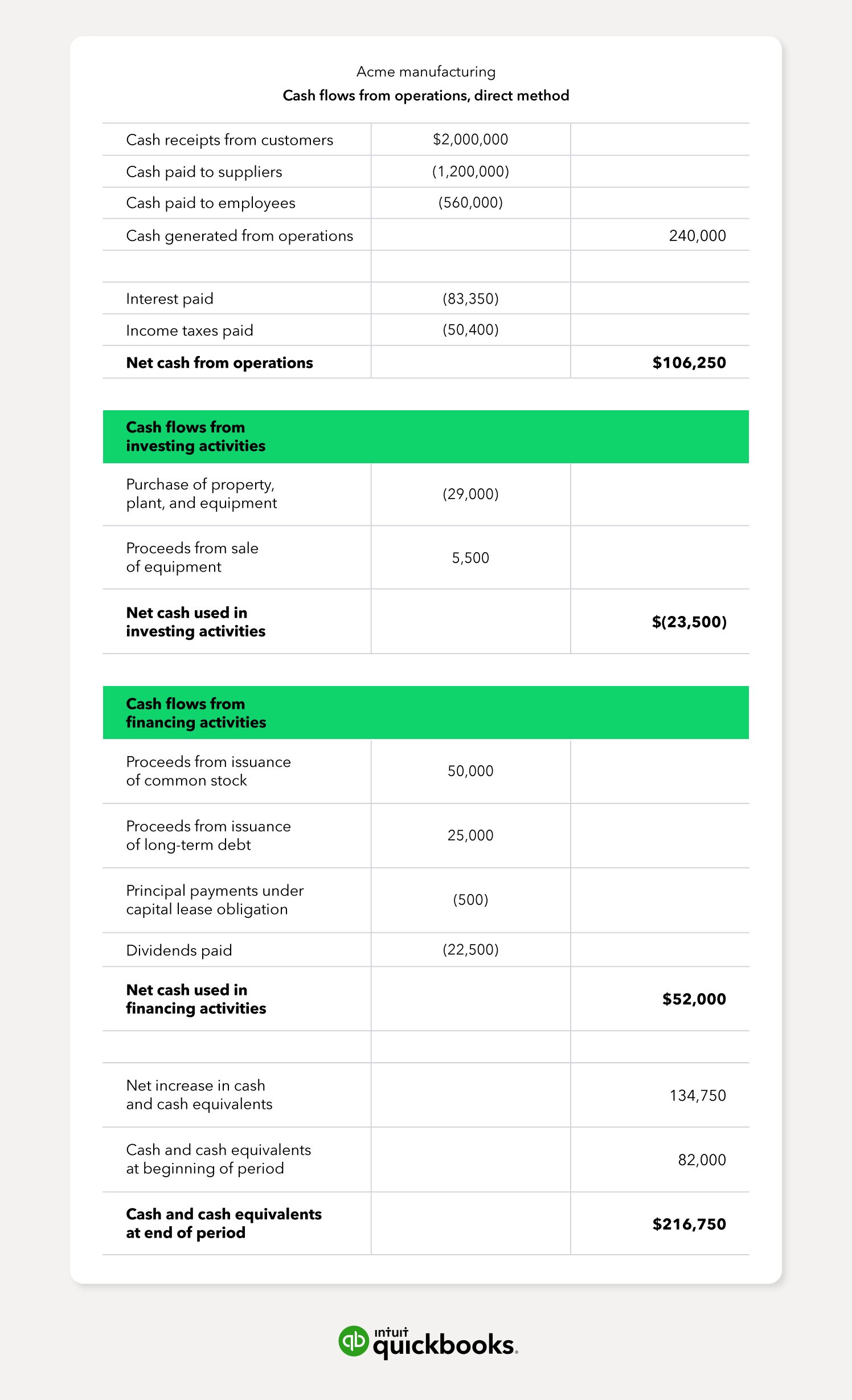

The cash flow statement separates cash inflows and outflows into three categories. To create a greenbacks flow argument, review each cash transaction in the checkbook, and assign the dollar amount to 1 of these categories:

- Greenbacks flow from operating activities: Operations refer to the day-to-twenty-four hours activities of managing a business. Centerfield has greenbacks inflows for customer payments, and cash outflows to purchase materials and fund payroll.

- Greenbacks flow from investing activities: If a business purchases or sells an asset for cash, the affect is posted hither. In 2021, Centerfield purchased $twoscore,000 in equipment for cash.

- Cash flow from financing activities: When a company raises money from investors, borrows funds, or pays down a loan, the cash transactions are classified as financing activities. Julie'due south business firm made $60,000 in loan payments during 2021.

The vast majority of your cash should exist generated from operating cash flows. Buying materials, managing payroll, and collecting customer payments are all operating activities. Your company's financial wellness depends on your ability to generate future cash flows from operations.

The $160,000 catastrophe balance in the cash catamenia statement equals the 12/31/21 cash balance in the balance sheet. If you lot browse the income argument, some line items are similar to (only not identical to) the cash inflows and outflows in the cash flow statement.

Centerfield's sales totaled $ii,080,000 during 2021, and the firm collected $2,000,000 in customer payments. Considering the house uses accrual accounting, annual sales may not equal the cash collected during the year.

Cash flows from operations tin exist completed using the direct or the indirect method.

Straight cash period method

The direct method refers to assigning cash inflows and outflows to the operations section by reviewing the firm'southward cash business relationship and line items of major transactions.

The Financial Bookkeeping Standards Board (FASB) creates accounting standards. FASB's Summary of Statement #95 recommends that firms employ the directly method for greenbacks menstruum from operations. If the direct method is used, the company must provide a reconciliation from net income to net cash flow for operations in a split up schedule.

Straight method example

In the example below, you'll find the argument of cash flows from operating activities, investing activities, and financing activities:

Every bit mentioned, the FASB requires a separate reconciliation to add further clarification to the sources of cash flow when the direct method is used:

Due to this boosted requirement of the direct method, many businesses choose (against the FASB's recommendation) to use the indirect method of reporting cash flows, which we will detail next.

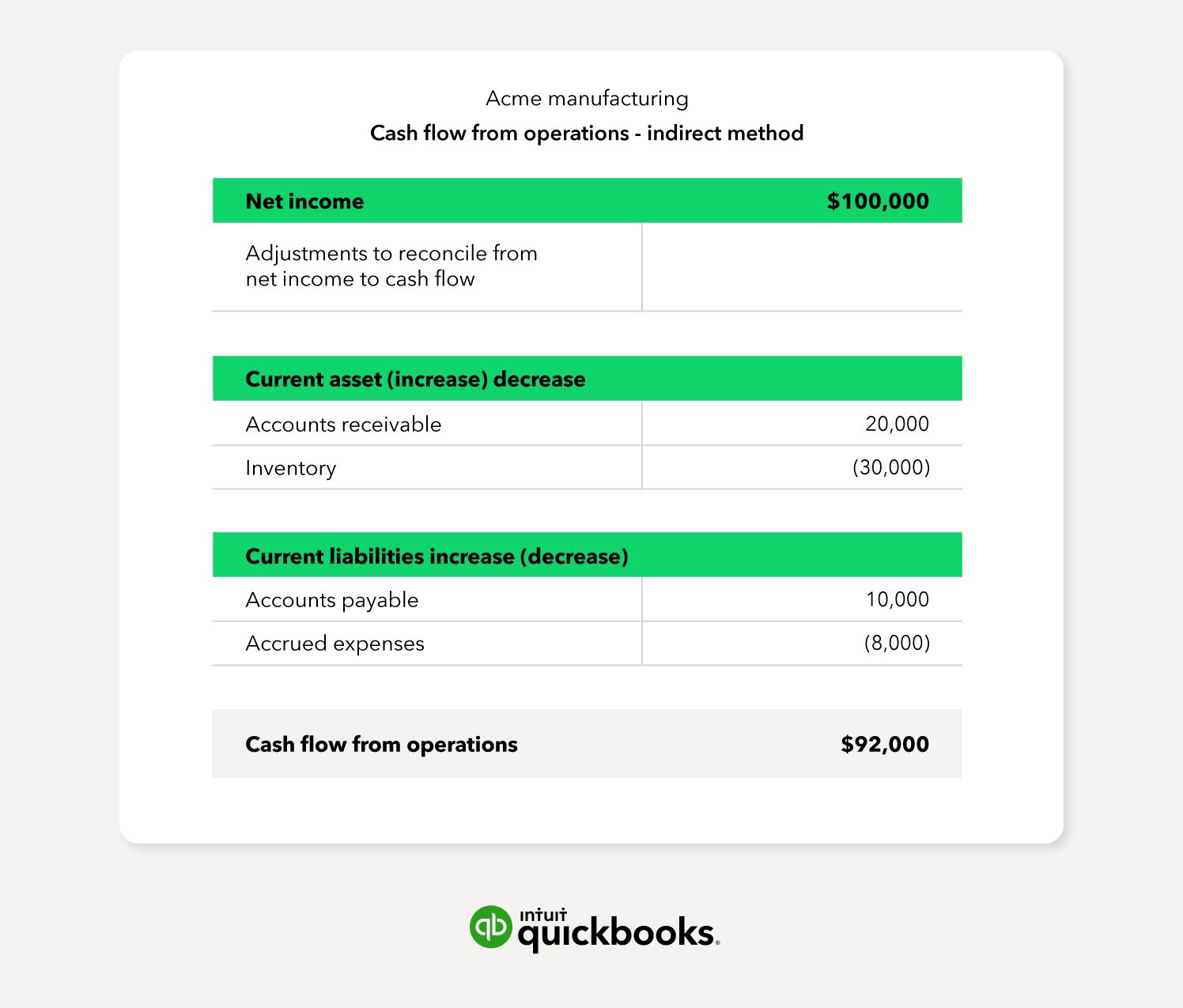

Indirect cash flow method

The indirect method for cash menses from operations begins with internet income. The report and so makes adjustments to reconcile from net income to internet cash period from operations.

Business owners should comply with accounting standards so that the firm's financial statements are comparable with other companies. If you're looking for investors, or because a business sale, yous need financial statements that comply with bookkeeping standards. Here'southward an example using the indirect method.

Example of the indirect cash flow method

Acme Manufacturing decides to apply the indirect method for greenbacks flow from operations. The argument begins with $100,000 in net income. Next, the schedule makes adjustments for current avails and current liabilities.

Current assets include greenbacks and cash equivalents (assets that will be converted into greenbacks within 12 months). Accounts receivable is a current asset account considering you expect to collect all customer payments within 12 months. Inventory is besides a electric current asset account because yous expect to sell inventory on hand and convert it to cash within a year.

An increase in current assets is subtracted, and a subtract is added to the schedule. The $xx,000 decrease in accounts receivable is added, and the $thirty,000 increase in inventory is subtracted.

Current liabilities are bills and other debts that must be paid within 12 months, including accounts payable. An increment in current liabilities is added, and a decrease is subtracted. Acme adds the accounts payable increase and subtracts the subtract in accrued expenses. The consequence is a $92,000 balance in greenbacks menstruum from operations according to the indirect method.

The statement of cash flows is the primary financial tool for managing cash flows but some companies besides use free greenbacks flow to assess business performance.

Free cash flow

Free greenbacks flow takes into account cash menses from operations, and the cash required to pay for uppercase expenditures (CAPEX).

Well-managed companies programme for uppercase expenditures, which may include investments in mechanism, equipment, and other long-term assets. A chain of restaurants, for instance, must somewhen replace ovens, refrigerators, and furniture. The price of replacement should be included in the restaurant chain's almanac upkeep.

If the eatery can generate more cash from operations than is needed to pay for capital expenditures, the company has some options. The extra greenbacks might be used to pay a dividend to investors, or retained in the business to expand operations.

A successful business concern must manage liquidity and solvency. Liquidity refers to your firm's power to generate enough current avails to pay current liabilities. Solvency has a long-term focus. If your company tin produce cash inflows over the long-term, y'all can pay for capital expenditures in future years and repay loan balances.

The statement of greenbacks flows and the complimentary greenbacks catamenia calculation are tools you can use to manage your business organization. One time you get-go using these tools, you need to make changes to improve greenbacks inflows.

How to increase cash collections

Improving cash collections can make a huge difference in your concern. You can avoid borrowing funds and the related interest expense. When you have the opportunity to add a business location or first a new product line, you'll take greenbacks to expand your business concern. Consider these strategies to increase cash inflows.

i. Create a formal drove policy

Firms that practise not closely monitor accounts receivable and enforce a formal collection policy may not generate sufficient cash inflows to operate. Your bookkeeping software should provide an aging schedule for accounts receivable, which groups your receivables based on when each invoice was issued.

You should monitor the aging report and implement a collections process to email and possibly call clients to ask for payment. Some firms email the customer when an invoice is over 30 days sometime and telephone call if an invoice is outstanding for threescore days or longer.

2. Manage cash used to purchase inventory

Many businesses practise not carefully plan for inventory purchases, and these firms risk the loss of a sale if inventory levels are too low. However, if you buy excess inventory, yous're using too much of your firm's cash. To maximize sales and conserve greenbacks, program for an catastrophe balance in inventory at the end of the calendar month.

An catastrophe inventory residue allows your company to fill customer orders in the commencement few days of the adjacent month. The formula for catastrophe inventory is:

Beginning Inventory + Purchases – Sales = Ending Inventory

Catastrophe inventory is oftentimes based on a percentage of monthly sales.

Presume, for example, that a hardware shop's beginning inventory balance of lawnmowers is 50 units, and that the company forecasts 300 mower sales for the month. If the business wants 30 mowers (10% of expected sales) in ending inventory, the number of mowers purchased should be:

300 Projected Sales + 30 Catastrophe Inventory – l First Inventory = 280 Purchased

Use the ending inventory formula to ensure that you maintain a sufficient amount of inventory. The formula will as well assistance yous conserve your cash for other purposes.

iii. Automate the invoicing procedure

Automation reduces the corporeality of time a firm spends on the invoicing process. Companies make fewer errors, and recurring invoices can exist processed in far less time.

Emailing invoices — and providing an online payment choice — encourages customers to pay immediately, which speeds up the cash collections. Best of all, invoice automation makes the ownership process easier and improves the customer'due south experience with your company.

iv. Ask for deposits, offer discounts

Don't hesitate to ask a customer for a deposit, particularly for large orders. Customers are in the habit of making deposits when they lodge products and services. Clients know that businesses must embrace costs to deliver a product. If you can make deposits a company policy, you'll increase cash inflows immediately.

Offer customers a discount if they pay inside 10 days. You'll earn less cash on the auction, just you'll collect money faster. If you lot increase cash inflows by offering a discount, you tin can avoid paying interest costs on a loan.

Take charge of cash flow management

Analyze the statement of cash flows to understand greenbacks inflows and outflows, and to forecast future cash needs. Each department of the greenbacks flow statement reveals different information about your business organisation. When you generate a cash catamenia study, think about the type of greenbacks in each section.

If cash flow from investing has declined, y'all may exist overspending on nugget purchases. A big increase in financing greenbacks inflows may relate to issuing stock to investors, or borrowing money.

Growing cash flows from operations, however, is the central to a successful business. If you can run your day-to-twenty-four hours operations and collect more cash over fourth dimension, you're generating higher profits and controlling spending.

Fortunately, you can purchase manufacture-specific accounting software that will generate a number of useful cash menstruum reports. Gear up a statement of cash flows each calendar month, and manage your concern with confidence.

This content is for information purposes just and should non exist considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Boosted information and exceptions may use. Applicable laws may vary by state or locality. No balls is given that the information is comprehensive in its coverage or that information technology is suitable in dealing with a customer's particular situation. Intuit Inc. does non have any responsibleness for updating or revising whatever information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does non warrant that the material contained herein will continue to be authentic nor that it is completely complimentary of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or corroborate these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Rate This Article

Source: https://quickbooks.intuit.com/r/growing-complex-businesses/statement-of-cash-flows/

Posted by: taylortheard.blogspot.com

0 Response to "How Will The Change In Accounts Payable Be Shown On The Statement Of Cashã¢â‚¬â€¹ Flows?"

Post a Comment